Business graduates in Canada can expect starting salaries that often range between $45,000 and $65,000 annually, with mid-career professionals earning well above $90,000 depending on their role, experience, and location. The numbers vary, yet the upward potential makes business degrees one of the most financially rewarding options in higher education. In this guide, we’ll break down earnings by degree, role, and city, along with insights to help you align your career choices with your income goals.

Key Takeaways

- Business graduates in Canada enjoy competitive starting salaries with strong growth potential over time.

- Degree type, role, and location significantly impact annual earnings.

- Understanding salary data helps you position yourself for smarter career moves and higher ROI.

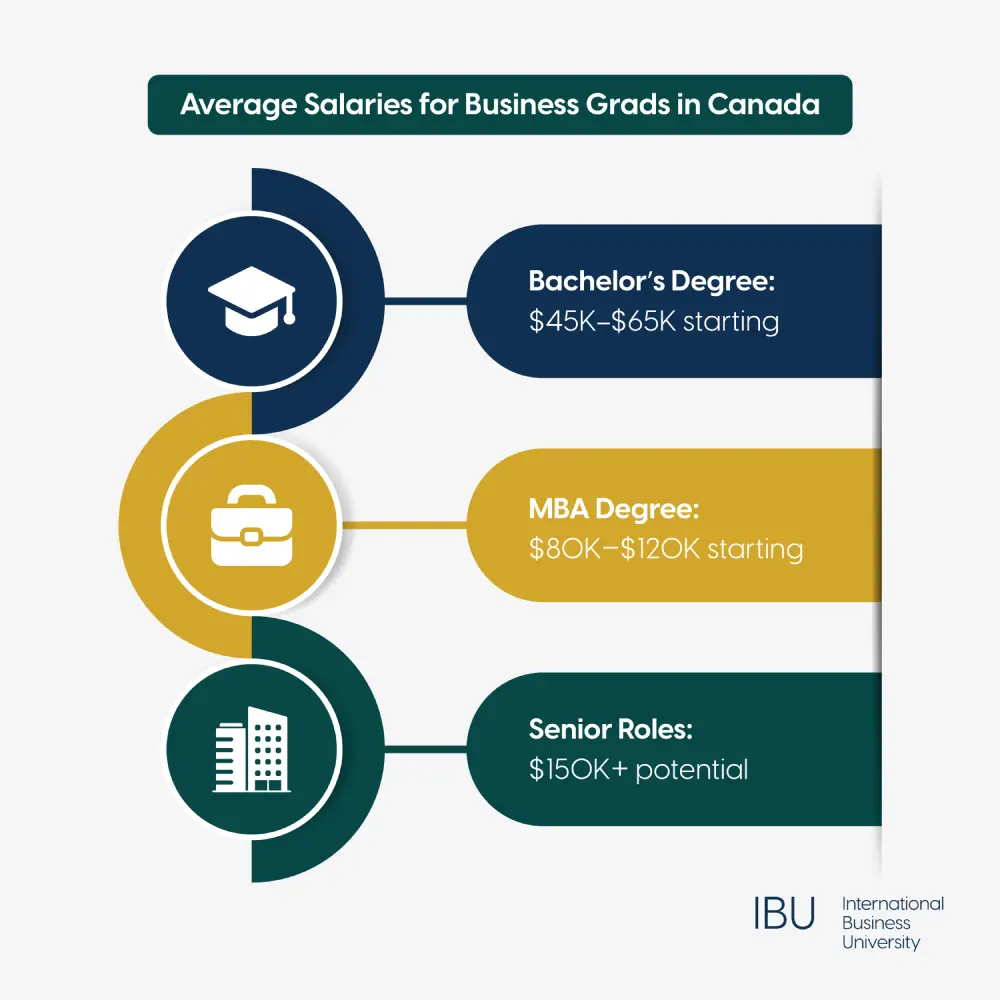

Salary Breakdown by Degree Type

Your degree level plays a direct role in your initial earning power. A Bachelor of Commerce or equivalent undergraduate degree often leads to entry-level positions in finance, marketing, supply chain, and human resources. Graduates from Canadian universities typically start between $45,000 and $65,000, depending on industry demand.

Moving up to a specialized master’s degree or MBA raises the stakes considerably. MBA holders in Canada frequently start in roles offering between $80,000 and $120,000, especially if they transition into consulting, investment banking, or corporate strategy. Many see bonus structures and performance incentives that can add another 6% to 17% to base pay.

Some graduates take a hybrid path, pairing a bachelor’s degree with professional certifications such as CPA, CFA, or PMP. This combination can boost earnings early in a career, closing the gap with MBA-level roles without requiring a full master’s program.

If you’re considering an MBA to accelerate your salary trajectory, understanding the program format matters. Choosing an MBA program that fits your goals is as much about aligning with your career ambitions as it is about financial return.

How Much Do Business Graduates Make by Role

The role you choose can influence your salary more than almost any other factor. Let’s look at common business career paths and how they compare.

Finance and Accounting

Entry-level finance analysts in Canada average between $45,000 and $65,000 annually, while senior financial managers can surpass $110,000. Certified accountants and chartered financial analysts often see faster salary growth due to the specialized expertise their roles demand.

Marketing and Sales

Marketing coordinators often start between $45,000 and $55,000, with marketing managers and sales directors earning $85,000 to $130,000. Roles tied to revenue generation, such as business development managers, often include commission structures that can significantly raise total earnings.

Operations and Supply Chain

Operations analysts and supply chain coordinators earn $54,000 to $65,000 starting out. Directors of operations can see salaries reach $120,000 or more, especially in industries like manufacturing, retail distribution, and logistics.

Consulting and Strategy

Management consultants typically start between $65,000 and $90,000, with senior consultants and engagement managers earning upwards of $150,000. The highest figures often go to those working in major firms serving corporate clients nationwide.

Technology and Data Analytics

Business graduates entering tech-focused roles, such as business analysts, project managers, or data strategists, often start around $60,000 to $75,000. Senior tech-business hybrids, particularly in AI or cloud solutions, can exceed $140,000.

Thinking of shifting into a higher-paying role?

Align your education with the career track that maximizes your ROI. The Smart Choice for your career.

Long-Term Career Growth and Salary Potential

Initial salary matters, yet the real payoff often comes in the years ahead. Business graduates who actively pursue promotions, certifications, and cross-functional experience can see their earnings double or triple within a decade.

For example:

- 5 years in: Many mid-career professionals move into specialist or supervisory roles, earning $70,000 to $90,000.

- 10 years in: Managers, senior analysts, and senior consultants often cross the $100,000 mark.

- 15+ years in: Executives, partners, and directors can earn $150,000 to $250,000, with bonuses and equity pushing total compensation higher.

Career mobility accelerates income growth. Moving between industries, shifting to high-demand sectors, and taking on leadership roles often leads to significant pay jumps. A graduate who starts in marketing for a mid-size company could later lead global campaigns for a multinational brand with a salary three times higher.

An advanced degree can shorten this timeline. An MBA graduate often enters at a higher level, reducing the time required to reach senior management or executive positions.

How Much Do MBA Graduates Make in Canada’s Big and Small Cities

Location shapes salary just as much as your degree. In large Canadian cities like Toronto, Vancouver, and Calgary, MBA graduates often secure starting salaries between $90,000 and $120,000. Finance, consulting, and tech sectors in these cities offer some of the most lucrative packages.

Smaller cities such as Halifax, Regina, or Kelowna may have starting salaries closer to $70,000 to $90,000 for similar roles. Yet the lower cost of living can make these earnings stretch further. A $90,000 salary in a smaller city often provides greater disposable income than $120,000 in a major metro area.

Remote work options have also blurred geographic limits. Many MBA graduates now earn big-city salaries while living in smaller, more affordable communities.

If you’re weighing location as part of your decision to pursue an MBA, comparing potential earnings against the cost of living is important. This is especially relevant if you’re considering an online MBA vs. a regular MBA to maintain location flexibility.

Understanding Salary Data to Make Smarter Career Moves

Knowing the numbers is only the start. Salary data becomes most powerful when you use it to make informed career decisions. This means looking beyond averages and identifying where you can stand out.

Actionable ways to apply salary data:

- Target industries with higher growth rates. Tech, finance, and consulting often outpace other sectors in pay increases.

- Negotiate using market benchmarks. Use regional salary reports to strengthen your position.

- Pursue in-demand certifications. Data analytics, project management, and AI strategy are increasingly valued.

- Factor in total compensation. Bonuses, equity, and benefits can significantly change your real earnings picture.

When you understand exactly how much do business graduates make, you can reverse-engineer your career path to hit your target income faster. The right education, combined with strategic career moves, can turn your degree into a high-yield investment.

Turning Salary Data into Career Power Moves

If you take a strategic approach, the question “How much do business graduates make?” becomes more than just curiosity. It becomes the baseline for a well-planned career that grows in both income and opportunity over time. Whether you’re aiming for $70,000 in a smaller city or $200,000 in a corporate hub, the right combination of education, role choice, and location can make your target a reality.

Ready to earn more without relocating?

IBU’s Online MBA gives you access to high-paying roles while you study from anywhere. The Smart Choice for your career growth.