For many finance professionals, deciding between an MBA (Master of Business Administration) and a CFA (Chartered Financial Analyst) is one of the first big career questions. Both qualifications carry weight, but in today’s competitive job market, students and working professionals are increasingly asking: Can I do an MBA and CFA together? The answer is yes; and combining the two can provide unmatched career value. If you’re exploring graduate education and certification options, understanding how an MBA and CFA together will help you make smarter decisions about your future.

Key Takeaways

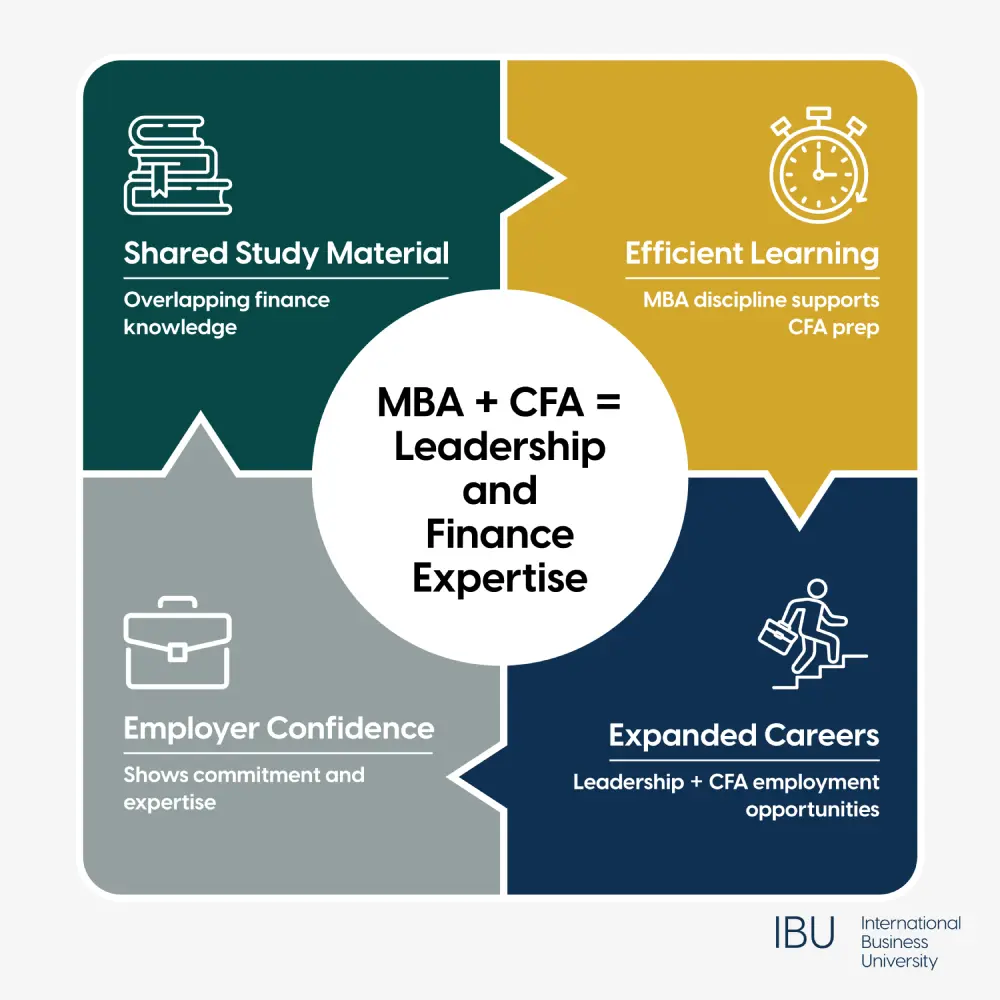

- Pursuing an MBA and CFA together strengthens both your business leadership and investment expertise, giving you a significant career advantage.

- Overlapping material between the two programs makes the process more efficient, while study habits built in one program support success in the other.

- Combining both credentials widens CFA employment opportunities, while also preparing you for executive-level positions that demand decision-making and management skills.

Overlapping Material Between MBA and CFA

When considering CFA vs MBA, one of the strongest reasons students pursue both is the overlap in subject matter. An MBA program offers a broad foundation across finance, strategy, operations, and organizational leadership. The CFA curriculum focuses specifically on investment analysis, financial modelling, and portfolio management.

This means an MBA gives you the management perspective while the CFA sharpens your technical finance skills. For example, courses in financial and management analytics within an MBA program can directly reinforce CFA exam preparation. The shared content allows you to progress more efficiently while strengthening both your strategic and analytical thinking.

Strengthen Your Finance Career with Both Credentials

Explore IBU’s specialized MBA streams in finance, technology, and global management. Combine them with CFA training for unmatched career flexibility.

Making the Most of Studying Techniques

Pursuing CFA and MBA qualifications together isn’t just about overlapping content, it’s also about developing discipline. Both programs require rigorous study schedules and high levels of focus. The skills you refine in your MBA courses, such as case study analysis and structured learning, can directly support your CFA exam preparation.

Think of it as cross-training for your career. The discipline you apply to one strengthens your ability to handle the workload of the other. For students who thrive under structured programs, completing an MBA in Finance vs CFA side by side can sharpen both business judgment and technical investment knowledge.

Broadening Your Expertise

One of the biggest advantages of pursuing an MBA and CFA together is the expanded expertise you gain. An MBA prepares you for leadership and organizational decision-making, covering areas like technology innovation, global business, and information systems management. The CFA program, meanwhile, deepens your command of topics such as valuation, portfolio management, and ethics in investment.

By completing both, you position yourself for a wider range of roles. You’re not only qualified for CFA employment opportunities in investment banking or asset management, but also for executive paths that require broader management knowledge. Employers value professionals who can bridge technical analysis with organizational leadership, and this combination signals exactly that.

It Demonstrates Long-Term Commitment

Earning an MBA requires years of study and project work. Completing the CFA program demands months of dedicated preparation for each level of examination. Pursuing both signals a level of ambition and commitment that stands out in interviews and performance evaluations.

Employers recognize the challenge of combining graduate education with a professional certification. That recognition often translates into faster promotions, broader career options, and trust in your ability to handle demanding projects. In short, CFA vs MBA isn’t always the right question, showing you can successfully manage both sends the strongest message of all.

MBA and CFA Together: Comparing Career Outcomes

To decide if this dual pursuit is right for you, it helps to consider MBA vs CFA outcomes and where each shines.

- MBA advantages: Opens doors to leadership, consulting, and entrepreneurial opportunities. Programs like Technology Innovation and Entrepreneurship or Global Business Management prepare you for executive-level growth.

- CFA advantages: Targets specialized roles in investment banking, asset management, and equity research, where analytical depth is prioritized.

- MBA and CFA together: Provides the full spectrum, technical investment expertise plus business leadership. This dual track makes you equally prepared for C-suite management or front-office finance roles.

When weighing an MBA in Finance vs CFA, think less in terms of competition and more in terms of synergy. The real advantage comes from integrating both paths.

Adding Flexibility for International Students

For international students, combining both qualifications provides an advantage when building careers in Canada and abroad. IBU’s MBA programs are designed for global students, offering specialized streams in Financial and Management Analytics, General Stream MBA, and Information Systems Management.

Completing your MBA while also progressing through CFA levels can maximize your time abroad, making your degree more valuable when returning to your home country or pursuing global finance roles. It expands both international business opportunities and finance-specific roles that demand a globally recognized credential.

How to Balance MBA and CFA Studies Together

Balancing two demanding programs requires careful planning. Students often wonder if combining them is realistic, but with the right strategy, it can be done effectively.

- Time management: Break study blocks into structured sessions for MBA assignments and CFA exam prep.

- Program sequencing: Some students prefer completing CFA Level 1 before starting their MBA, while others integrate both simultaneously.

- Practical application: Use real-world MBA projects to apply CFA theory, such as analyzing financial statements or evaluating investment strategies.

This integrated approach turns your studies into a cycle of reinforcement, what you learn in class can be applied to exam prep, and vice versa.

Starting Your MBA and CFA Journey with IBU

If you’re considering this path, the first step is choosing an MBA program that supports your long-term goals. IBU provides specialized MBA streams designed for ambitious professionals who may also be preparing for CFA exams. The admissions process is efficient, within 7 to 10 days, applicants typically receive a reply or pre-offer letter.

From there, students can move forward with tuition payment and student visa applications. Once admitted, you’ll have access to faculty support, peer networks, and the flexibility to align your studies with CFA preparation. For international students, this dual approach can transform your career prospects and broaden your access to both Canadian and global finance opportunities.

FAQ

Can I do CFA and MBA at the same time?

Yes, you can pursue CFA and an MBA at the same time, though it requires strong time management and commitment. IBU’s MBA programs are designed with flexibility for working professionals, making it possible to balance CFA preparation alongside graduate studies. Many students combine both paths to strengthen their finance expertise and leadership credentials.

What is the salary of CFA with MBA?

Professionals who hold both a CFA and an MBA often command higher salaries due to their combined financial expertise and strategic leadership skills. While compensation varies by industry and location, having both credentials can position you for senior roles in investment banking, asset management, and consulting. Graduates from IBU’s MBA programs gain a competitive advantage when paired with CFA certification.

How many people have CFA and MBA?

Globally, a significant number of finance professionals pursue both CFA and MBA, though the exact figures vary by country and industry. The CFA Institute notes that many candidates also hold advanced business degrees to expand their career opportunities. At IBU, we see strong interest from students who strategically combine the two to accelerate their growth in finance and management.

Who earns more CFA or MBA?

Earnings depend on role, industry, and region, but in general, MBA graduates tend to earn more in leadership and management positions, while CFAs excel in specialized finance roles. Combining both can maximize earning potential by opening doors to executive-level opportunities in global finance. IBU’s MBA equips you with the business leadership skills that, paired with CFA expertise, create the strongest career trajectory.

Why MBA and CFA Together Make Sense

Deciding between CFA vs MBA no longer has to be an either-or choice. Combining both gives you the business leadership foundation of an MBA with the technical finance mastery of the CFA designation. The synergy between the two prepares you for roles across corporate management, financial institutions, and global markets.

If you want to maximize your future in finance, completing an MBA and CFA together can be the smartest long-term investment you’ll ever make.

Learn Smarter, Not Harder

Balance MBA coursework with CFA exam prep using IBU’s flexible online and in-person study options.